By the numbers: 25 things about Eagle Investment Group for its 25th year

Published on April 28, 2025

College of Business and Economics

With 2025 being the 25th year of Ashland University’s Eagle Investment Group (EIG), here are 25 things you should know about it:

- It is a two-semester class, not a club. Most of the students are business majors, particularly in finance.

- The class is mostly seniors. That’s mainly because two prerequisites are needed: an introductory finance investment course and a portfolio management class.

Image

- Students invest real money. What started as a $250,000 fund from the university, doubled by 2008 with more donations from AU and dividends from investments, is now around $2 million to $2.2 million. It is part of the university’s $80 endowment. EIG follows the investment policy developed by the students and adopted by AU’s Board of Trustees. “As dean, I wouldn’t want it any other way,” said AU College of Business Dean Dan Fox. “We want our students to have real accountability that will be similar to what they experience when they leave here.”

Image

Image

Image

- Tom Harvey, a retired AU business professor and longtime banker before teaching, started EIG. Harvey said Lucille Ford, who had been involved with AU for many years, particularly COBE, asked him if his students would like to manage some money and she convinced the university’s Board of Trustees to start them off with the $250,000 seed amount. “It was really different in terms of other classes that were held around the university,” Harvey said. “It became a place where the students loved to come and talk about the market. I never put anything in the portfolio or took anything out of it. It was all the students’ work. The thing just took off by itself.” When he established it, Harvey said he never thought it would last for 25 years.

Image Image

Image

- Terry Rumker was another key EIG instructor. Because he worked at Fidelity Investments before teaching at AU, Rumker said Harvey asked him to help develop EIG and eventually taught the class for a few years. “When we first developed it, the idea was to have a unique experience for our students,” Rumker said. “When they walked out of AU, they wouldn’t question their skill sets. That was the goal for them: to manage money so they could hit the ground running when they graduated.”

Image Image

Image

- Jim Falter also taught EIG. Falter taught EIG for a few years, before Rumker and after Harvey, who taught the class for many years.

Image Image

Image

- Associate Professor of Finance Dennis Witherspoon, Ph.D., is the current EIG instructor. For the past six years, Witherspoon (known as Dr. Spoon by his students), has tried to run EIG more like a job than a class to help prepare the students for an investment workplace.

- The focus is on long-term portfolio investment to avoid risk. “At some colleges, the focus is more stock picking; we’re more portfolio management,” Witherspoon said. “We take a long-term approach and all the students are involved to the same extent. Everyone has responsibility to get the job done.”

Image

- Investments are in many sectors. Communications, energy and technology are a few of the sectors the students invest in, as well as health care, utilities and real estate.

- There are many types of investments. Stocks, bonds, ETFs (exchange traded funds), treasury bills and CDs are a few of the types of investments the students have in the portfolio.

- Witherspoon tries to improve EIG each year. “I keep trying to bring in added technology and added knowledge,” said Witherspoon, who asked for and received a full-wall white board, two projectors and dual monitors for each workstation when he started teaching EIG.

Image

- Ticker outside the classroom added in 2018. It shows real-time prices of current EIG’s investments. Before 2018, a smaller ticker was inside the classroom at the front of the room near the ceiling.

Image

Image

- FactSet is the research database used. During Rumker’s time and at the start of Witherspoon’s tenure, they used Bloomberg terminals, and before that Morningstar, which were often purchased through fundraisers such as golf outings. That’s a far cry from …

- The first classes met in a regular Miller Hall classroom and much of the research was done at the library. “We would go to the library and use the Wall Street Journal to get stock prices, which wasn’t real-time prices,” said Jason Lieberman, a member of the first EIG class in 2000. “A project we did was learning how to get data from the internet. We used Yahoo Finance for a lot of data.” Then Lieberman later added: “It’s unbelievable to see how far (EIG) has come.”

Image Image

Image

- EIG received a trading room in 2004. That was when the Dauch College of Business building was built. According to a news release at that time, AU figured its trading room was one of just about 25 in colleges and universities in the country.

Image

- The trading room has a bell. Similar to the ringing of a bell on the New York Stock Exchange the one in the corner of the trading room is rung when an investment sale or purchase is made.

- Enrollment has grown. The first class had just a handful of students, and now it usually has almost 20, which meant a second section of the course eventually had to be added. This semester, the first section has eight students and the second nine.

Image

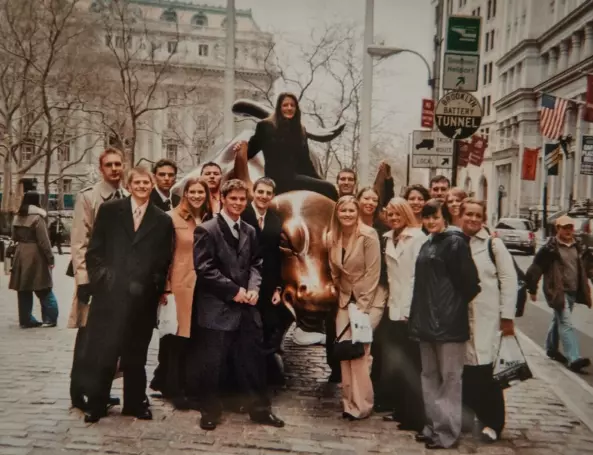

- An annual spring trip to New York used to be part of EIG. “The students have a lot of fond memories of their trip to New York, visiting Wall Street and getting on the floor of the New York Stock Exchange,” Fox said. While Witherspoon doesn’t lead a trip to NYC, members in the two-year-old Finance Club, many who are EIG students, took a trip to The Big Apple in late January.

Image

- Performance measured quarterly. “We present our results to the Board of Trustees’ Investment Committee and all the students participate, presenting in their sector,” Witherspoon said. “I coach them through the process to make sure everything is accurate.” Students can’t make changes in their sector without approval from the rest of the class through a presentation.

Image

- University support key to EIG’s success. That is especially true of the Investment Committee, which currently includes Ronald Alford, Richard Veres, James Smail and Dustin Ness, a 2004 AU grad who was in the second ever EIG class. “Whenever they reach out, I am willing to give them my time,” Ness said. “Even before I was a trustee, I would come to the (EIG) class and talk to the students and have a Q & A. I’ve done that dozens of times.”

Image

- EIG students have shined in competitions over the years. Some of the most recent were four students (Jacob Boerner, Jessica Kritschil, Jacob Koehler and Justin Stritmatter) earning second-place honors in the Quinnipiac Global Portfolio competition’s Undergraduate Value Division in 2021.

Image

- The experience from EIG helps with job interviews. “I have been asked so many times in job interviews about the sectors I manage,” said current EIG student Emma Conway, who has a finance job lined up after graduation with JP Chase Morgan. “It’s something not a lot of students get to do.”

Image

- It’s a favorite class for many students. “I knew about (EIG) in high school,” said senior finance major Brian Wolfe. “That was one of the reasons I wanted to come to Ashland: Eagle Investment Group.”

- Some students have changed their major to be a part of EIG. “I did not start out having finance as a major, but when I heard of EIG I immediately wanted to get involved,” David Grim said in a 2018 Collegian article when he was a senior. “I switched my major to finance from nursing during my sophomore year and immediately began doubling up on classes so that I would be eligible for the group.”

Image

- There have been a lot of success stories. Lieberman (a vice president/financial advisor and portfolio manager for Morgan Stanley Wealth Management in Florida) and Ness (managing partner for Waterstreet Financial in Sandusky, Ohio, and branch manager, Raymond James Financial Services) are two of the many EIG success stories. “I’m so proud of its legacy,” Lieberman said.

Image